maryland ev tax credit form

Electric car buyers can receive a federal tax credit worth 2500 to 7500. Purchasers were encouraged to file a form to reserve a place in the queue if and when additional funding is authorized.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Marylanders who purchased a plug-in electric vehicle since funds were depleted for the 3000 state excise tax credit have been waiting to see if the legislature will reauthorize funding for the program.

. Use of High Occupancy Vehicle HOV Lanes. 6601 Ritchie Highway NE Glen Burnie Maryland 21062 410-768-7000 1-800-950-1MVA Maryland Relay TTY 1-800-492-4575 Web Site. The credit is for 10 of the cost of the qualified vehicle up to 2500.

Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates. Enter the amount up to 50 per deer of qualified expenses to butcher and process an antlerless deer for human consumption. Business Licensing and Consumer Services RE.

See above To claim the credit you must complete Part B of Form 502CR and submit with your Maryland income tax return. To get this credit. Governor Mary Beth Tung Director.

November 19 2018 Bulletin. A new application must be filed every year if the applicant wishes to be considered for a tax credit. Maryland Heritage Structure Rehabilitation Tax Credit.

All Required Fields on this Form Must be Filled Out Completely. 502S is used to calculate allowable tax credits for the rehabilitation of certified rehabilitation structures completed in the. Form for reporting retirement income as per enacted House Bill 1148 by the Maryland General Assembly during the 2016 Session.

If the purchaser of an EV has an income that doesnt exceed 300. For Maryland residents who purchase a new EV or PHEV within state lines there are several incentives to take advantage of thanks to the Maryland Clean Cars Act of 2019 HB1246. Enter here and on Part AA line 7.

Hogan Jr Governor Boyd K. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Governor Mary Beth Tung Director Please Fill Out Form Electronically Print Sign and Return to MEA.

Hogan Jr Governor Boyd K. The Maryland Electric Vehicle Tax Credit. Maryland Excise Tax Credit The Maryland excise tax credit expired on June 30 2020 but could be funded in the future.

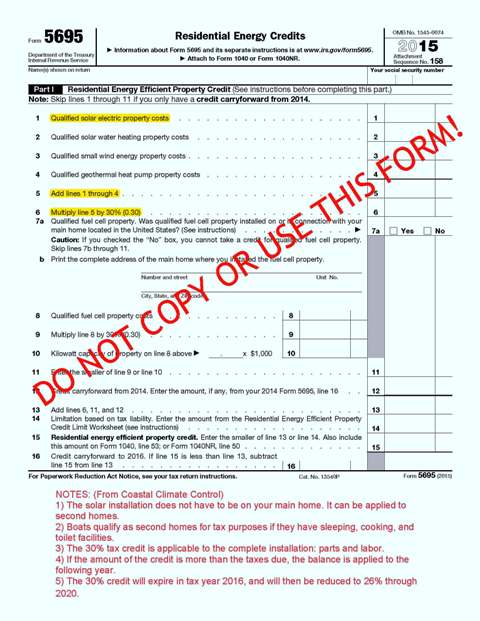

For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and Publications website. Homeowners Property Tax Credit Application Form HTC 2022 The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. This credit is in addition to the subtraction modification available on the Maryland return for child and dependent care expenses.

The rebate is up to 700 for. Name of Business Maryland Central Registration Number ederal Employer Identification NumberF Motor Fuel Tax Account Number if applicable. Box 549 Annapolis MD 21404-549 Complete this section.

You must report the credit on Maryland Form 502 505 or 515. Please Fill Out Form Electronically Print Sign and Return to MEA. Electronic Funds Transfer Program PO.

Residential Application Form Maryland Electric Vehicle Supply Equipment Rebate Program Lawrence J. Maryland Retirement Income Form. Funding is currently depleted for this Fiscal Year.

The state offers a one-time tax credit of 100 per kilowatt-hour of battery capacity up to a maximum of 3000. The HOV Hybrid permits are effective October 1 2018 through September 30 2019 only 2000 HOV Hybrid Permits will be issued. Tax credits depend on the size of the vehicle and the capacity of its battery.

The Clean Cars Act of 2021 as introduced had several goals. Maryland Electric Vehicle Supply Equipment Rebate Program. First was to fund the backlog of applications from EV purchasers who are on the waitlist from the prior EV tax credit program.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. COMRAD-012 2021 Page 3 NAME SSN PART G - VENISON DONATION - FEED THE HUNGRY ORGANIZATIONS TAX CREDIT 1. Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit.

Alternative fuel options continue to grow in popularity as more and more manufacturers begin to focus on their EV lineups. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. Complete IRS Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit and submit with your income tax return.

This form must be completed and faxed to 410-260-6214 or mailed to. MARYLAND FORM 502CR INCOME TAX CREDITS FOR INDIVIDUALS Attach to your tax return. Excise Tax Credit for Plug-In Electric Vehicles.

Any applications for HOV hybrid permits will need to be presented in person or mailed to 6601 Ritchie Highway NE Room 104 Glen Burnie MD 21062. Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level 2 smart. 2022 EV Tax Credits in Maryland.

The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. As our Pohanka Automotive Group customers begin to familiarize themselves with these types of vehicles wed like to take the time to explain some of the incentives you can access. If you have any questions please email us at.

893 of the funds budgeted for the FY22 EVSE program period have been committed with 19258900 still available. All Required Fields on this Form Must be Filled Out Completely. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. Funding Status Update as of 04062022.

For more general program information contact MEA by email at michaeljones1marylandgov or by phone at 410-598-2090 to speak with Mike Jones MEA Transportation Program Manager. WwwMVAmarylandgov Page 1 of 1 D-11-18-01 Date. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

The permit must be affixed on the rear of the vehicle in a visible.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

/1040-V-df038816cc244b248641f447493a030d.jpg)

Form 1040 V Payment Voucher Definition

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Latest On Tesla Ev Tax Credit March 2022

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Solar Tax Credit And Your Boat Updated Blog

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Cost To Charge An Electric Car How It Affects Your Electric Bill

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites